Video Analytics For Bank

Unlocking the Future: AI-Enabled Video Analytics Revolutionizes Banking Security

In the dynamic landscape of the financial industry, staying ahead in terms of security is paramount. With technological advancements paving the way, Artificial Intelligence (AI) emerges as a game-changer, particularly in the realm of video analytics for banks.

Embracing the Power of AI: Transforming Banking Security

Gone are the days when traditional surveillance systems were sufficient to combat evolving security threats. Enter AI-enabled Video Analytics, a cutting-edge solution that not only detects potential risks but proactively prevents them.

Enhancing Surveillance Efficiency

AI algorithms elevate surveillance to new heights, providing banks with real-time insights and analysis. This transcends the limitations of manual monitoring, offering a proactive approach to security rather than reactive.

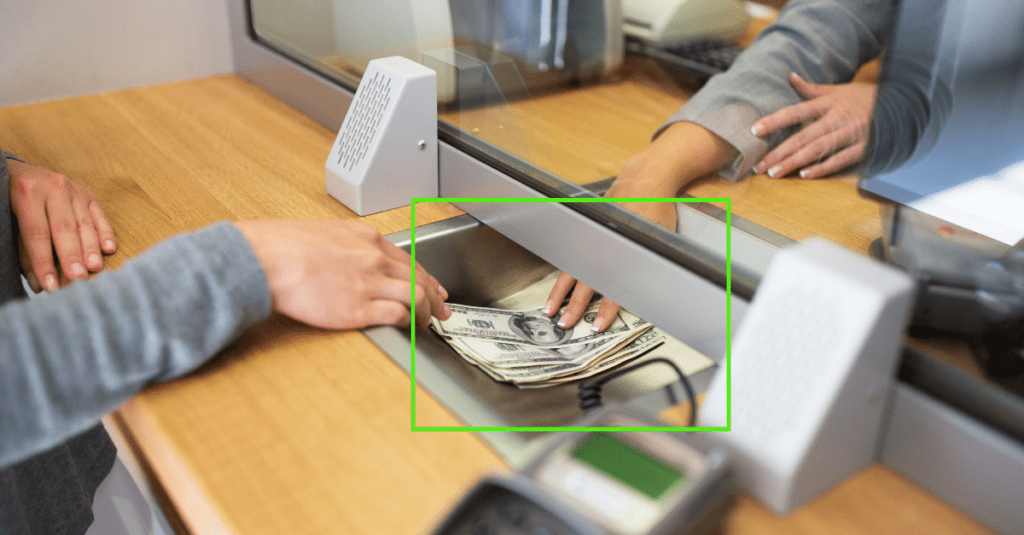

Fraud Prevention in Real Time

One of the primary concerns for banks is fraudulent activities. AI-driven video analytics identifies suspicious patterns and behaviors instantaneously, significantly reducing the risk of financial fraud.

Customer Safety Redefined

Banks prioritize customer safety, and AI plays a pivotal role in ensuring it. The system can recognize and respond to unusual activities, safeguarding both the physical and digital spaces within the banking environment.

The Synergy of AI and Banking: A Seamless Integration

Incorporating AI into video analytics is not just a technological upgrade; it’s a strategic move towards fortifying the very foundations of banking security. The marriage of AI and banking operations is a synergistic alliance, ensuring a robust defense against emerging threats.

How AI Works its Magic

Understanding the mechanics behind AI-enabled video analytics is crucial. The technology employs machine learning algorithms that continuously evolve, learning from patterns and adapting to new security challenges.

Breaking Down the Benefits

1. Proactive Threat Detection

AI doesn’t wait for a threat to occur; it anticipates and prevents. Proactive threat detection ensures that potential risks are nipped in the bud, safeguarding the bank’s assets and customer data.

2. Cost-Efficiency

While the initial investment in AI technology might seem substantial, the long-term benefits far outweigh the costs. The efficiency of AI in preventing fraud and enhancing security ultimately leads to significant cost savings.

3. Adaptability to Changing Threats

Security threats are ever-evolving, and so is AI. The adaptive nature of AI ensures that it stays one step ahead, constantly evolving to counter new and sophisticated security challenges.

Empowering Banks, Ensuring Trust

In a world where trust is the cornerstone of banking relationships, AI-enabled video analytics emerges as the guardian of this trust. Banks that embrace this technological leap not only fortify their security measures but also signal to their customers that their safety is a top priority.

Conclusion

As the financial landscape continues to evolve, the integration of AI-enabled video analytics becomes not just a choice but a necessity for banks aiming to secure their future. By harnessing the power of AI, banks not only safeguard their assets but also foster a sense of trust and confidence among their clientele. The era of AI in banking security has dawned, and those who seize its potential will lead the way into a safer and more secure banking future.