AI Eyes on Security: How Real-Time Video Analytics is Shaping the Future of Banking

Introduction

What is Real-Time Video Analytics?

Real-time video analytics uses advanced AI tools to analyze live video feeds instantly. This technology turns passive video surveillance into proactive security measures, significantly enhancing safety and operational efficiency.

How Video Analytics Has Changed Over Time

Initially, video surveillance required human monitoring. Now, AI algorithms can detect and respond to threats autonomously, greatly improving security outcomes.

The Impact of Real-Time Video Analytics on Banking Security

Making Bank Branches Safer

Real-time video analytics identify threats as they happen. This technology monitors for suspicious behavior, allowing immediate intervention to prevent incidents.

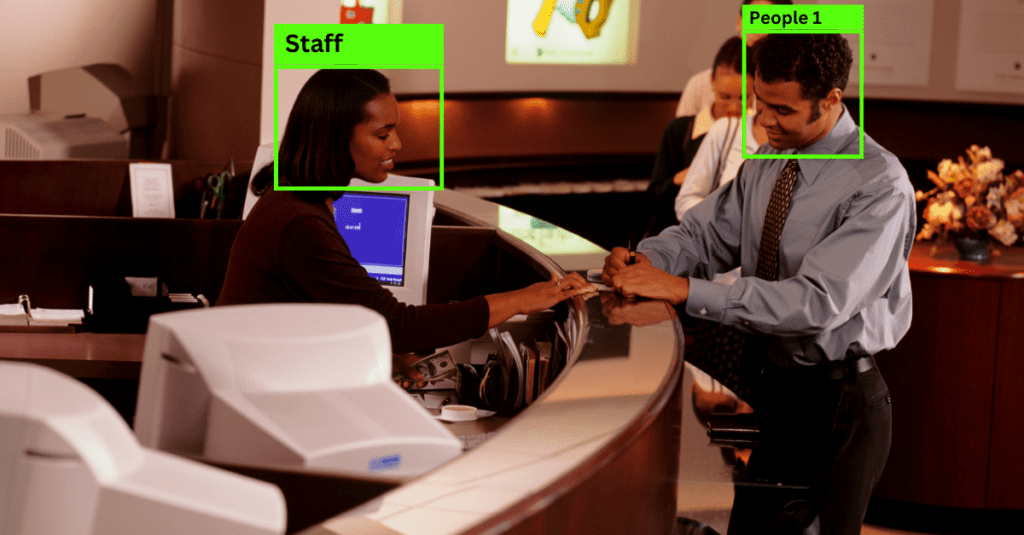

Stopping Fraud and Unauthorized Access

Facial recognition enable banks to identify unauthorized individuals and alert security teams instantly, preventing fraud and unauthorized entry.

Operational Efficiency and Customer Experience

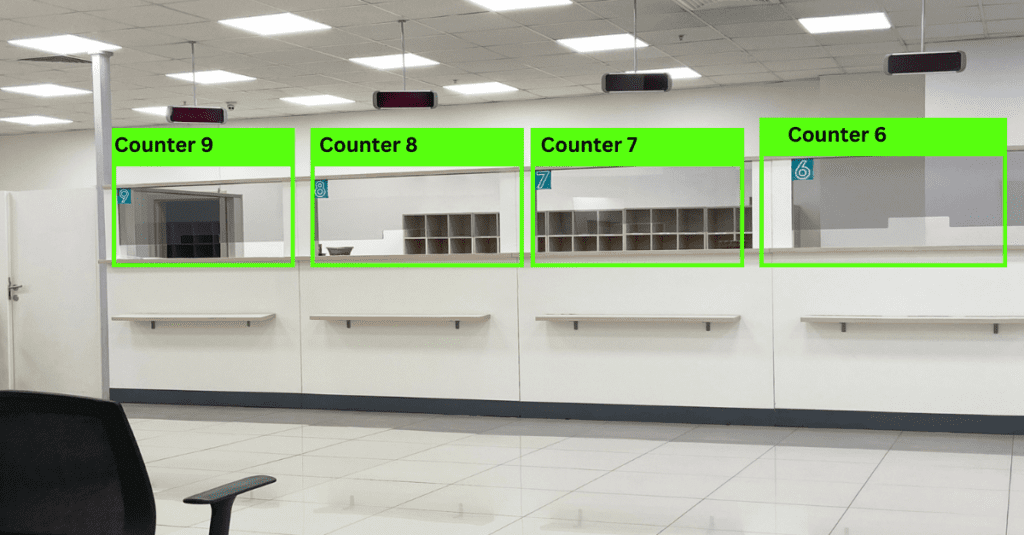

Streamlining Bank Operations

Video analytics optimize staff workloads by identifying peak times and reallocating resources accordingly. This reduces operating costs and improves efficiency.

Improving Customer Service

Analyzing customer behavior allows banks to shorten wait times and offer personalized services. Better queue management enhances the overall customer experience.

Ensuring Compliance with Regulations

Video analytics ensure compliance with legal requirements by protecting data privacy and meeting regulatory standards. This minimizes the risk of legal issues.

Case Studies and Real-World Applications

Examples of Banks Using Video Analytics

Top banks have successfully implemented video analytics, enhancing security and operational efficiency. These success stories provide valuable insights into best practices.

Innovative Uses in Banking

Advanced security systems and customer service enhancements are among the innovative applications. Video analytics continually push the boundaries of traditional banking.

Future Trends in Video Analytics for Banking

Advancements in AI and Machine Learning

Predictive analytics and continuous learning systems represent the future of video analytics. These advancements will further enhance banking security.

Combining with Other New Technologies

The integration of IoT and blockchain technology with video analytics will offer more robust security solutions.

The Rise of Smart Branches

Fully automated bank branches are on the horizon. These smart branches will revolutionize traditional banking, offering unprecedented convenience and security.

Challenges and Considerations

Technical Challenges

Data processing and storage are significant challenges. Banks must also address system integration issues to ensure seamless operation.

Security Concerns

Potential weaknesses in video analytics systems can pose risks. Implementing robust security measures is crucial to mitigate these risks.

Ethical and Privacy Issues

Balancing security with privacy is essential. Banks must follow ethical guidelines to protect customer data while enhancing security.

Frequently Asked Questions (FAQs)

Real-time video analytics use AI to analyze live video feeds, enhancing security and operational efficiency in banks.

AI detects threats and suspicious behavior in real-time, providing instant alerts and preventing fraud.

While enhancing security, banks must ensure data privacy and comply with legal standards to protect customer information.

Banks use encryption and other security measures to protect data collected through video analytics.

Predictive analytics, IoT integration, and smart branches are some of the expected advancements in video analytics for banking.

Smaller banks can adopt scalable solutions and leverage cloud-based services to implement video analytics cost-effectively.

Yes, many top banks have successfully implemented video analytics, enhancing security and operational efficiency.

Conclusion

Summary of Key Points

Video analytics offer numerous benefits, including enhanced security, improved operational efficiency, and better customer service. The future of banking security is promising with ongoing advancements in AI and related technologies.